The Cliff Effect occurs when families’ income increases enough that they lose eligibility for public assistance supports like food, childcare, and housing, but not enough to afford these on their own.

The result is that an increase in wages leads to a decline in standard of living. It causes people to turn down raises and promotions and is a major factor in perpetuating multi-generational poverty.

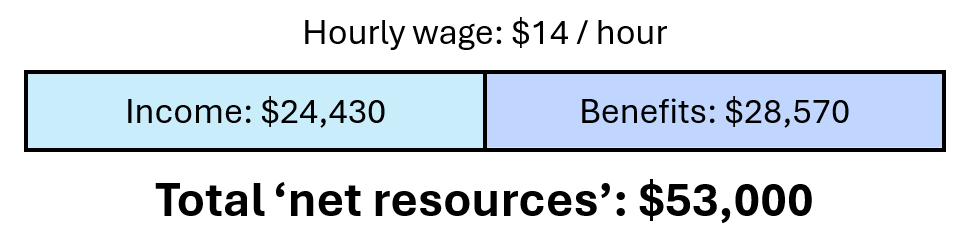

- Mary earns $14 per hour, which is $24,430 per year after taxes.

- Additional housing, childcare, and food assistance benefits worth $28,570 brings her net resources to $53,000.

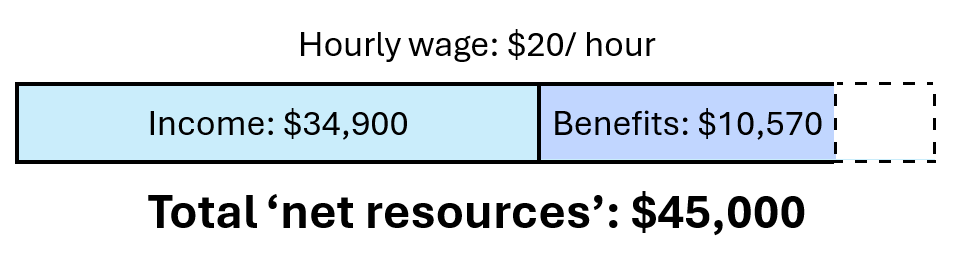

Mary takes a new job, where she gets a raise to $20 per hour!

- Her net salary has now increased to $34,900!

- BUT she loses $18,000 in benefits because of that increase.

- Now her net resources are only $45,000, a decrease of $8,000 in net resources even though she got a raise.

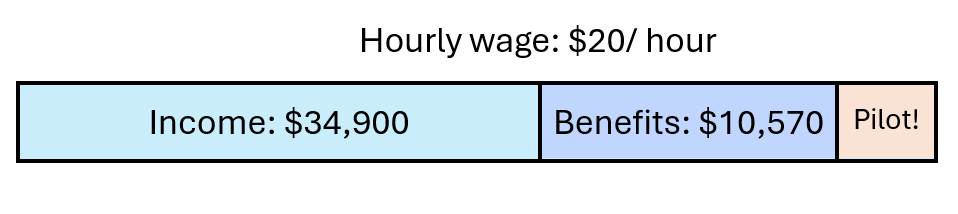

The Cliff Effect Pilot Program, which was passed by the Massachusetts legislature in the 2022 Economic Development Bill, would fill the gap and provide Mary with $8,000 as she continues to advance her career, allowing her to take the job!

Springfield WORKS is implementing the innovative three-year Cliff Effect Pilot. We will work with up to 100 residents and their families across Massachusetts who are receiving any form of public assistance to attain higher-paying jobs and careers.

As participants’ income increases and the value of their safety net benefits decrease, the program will provide supplemental cash benefits to bridge the gap. Participants will also receive one-on-one career and financial coaching to reach their goals, and connections with several participating employer partners with living wage employment opportunities.